We bring you the latest info from Malta. Previously we’ve talked with Sarah Aquilino from Residency Malta in order to clear out some outstanding questions on the Malta Nomad Residence Permit.

For updates on this, please see No Tax Exemption under Malta Nomad Residence Permit.

Local Taxes

The purpose of the Nomad Residency permit is to enable holders to retain their current employment whilst legally residing in Malta. This is open to anyone who is able to work remotely via telecommunication technologies.

The Residency Malta Agency confirmed that Remote Workers who have been approved for Nomad Residency are not required to pay local income taxes on the income from their remote job that is not remitted to Malta. Nor do they have to do local fillings for any income they derive from that remote job. This means that income arising outside of Malta and not sent to Malta is not taxable when holding a Nomad Residence Permit.

Even better, if you continue to qualify, it is possible to renew your permit and stay in Malta for a maximum of 3 years. This potentially means 3 years without an income tax.

That said, please see below for the No Legal Bases For Tax Exemption below.

No tax from the remote job for up to a year.

Tax Residency

Nomad Residence Permit holders are considered non-domicile temporary residents meaning that even if they spend over 183 days in Malta, they do not become tax residents there. The only requirement is that they have tax residency back home.

No local tax residency, but need tax residency back home

Taxes Back Home

Holders of the Nomad Residence Permit are not allowed to work for nor to drive any income from any local entity and are expected to pay their taxes in the countries in which they are normally residents. Theoretically, Nomads who are self-employed are not totally prohibited from providing services to Maltese companies and customers, but if they do, they will have to apply for a different residence permit based on their self-employment in Malta, register, and pay local taxes in Malta.

Employer Perspective

Employers of remote workers are not required to register or have a payroll in Malta, as long as they don’t provide any services to local clients. Income arising outside of Malta and not sent to Malta is not taxable. There is also no need to pay any social contribution.

Here is what Residency Malta, the agency responsible for the Nomad Residence Permit communications, confirmed to us:

Kindly note that Nomad Residence Permit holders will not be subject to personal income tax since their employment is already taxed at origin. Nonetheless, they will be subject to consumption tax like all other residents. Same goes for the company, no taxes or welfare will be paid in Malta by the company either.

No local registration, payroll, or filling for foreign employers of Nomads

Legal Bases for Tax Exemptions or lack thereof

Residence Malta Agency is the body promoting the Nomad Residence Permit and they claim that there is no income tax (see abvWe have been told to contact the Office of the Commissioner for Revenue for more detailed tax questions. We did, and they said that:

The Income Tax Act currently does not cater for the exemption of tax on income earned from remote working by Nomad Resident Permit holders. Therefore at the moment, we are not aware of how the tax exemption for Nomad Residence Permit holders is going to apply.

No legal bases for tax exemption for Digital Nomads

This shows either huge miscommunication issues between different departments in Malta’s government. Or a serious issue where the Nomad Residence immigration team hasn’t fully fleshed out all the legal bases that would allow for the tax exemption for holders of the Nomad Residence Permit.

It might mean that there is no specific tax exemption for Nomads and that for Maltese income tax purposes, they will be considered as individuals who are (temporary) residents but not domiciled in Malta. If that would be the case they will be subject to taxation in Malta only on income arising in Malta and on any foreign income remitted to Malta. They will not be taxable in Malta on income arising outside Malta, which is not received in Malta, and on capital gains arising outside Malta, regardless of whether they are received in Malta, or otherwise.2 Maybe this is exactly how, Residence Malta Agency was hoping, Nomads will be treated, but they haven’t actually confirmed it with the tax office ;D

Either way, if you are planning to apply for the Nomad Residence Permit, proceed with caution.

Pros & Cons

Let’s do a quick list of the Pros & Cons of the Nomad Residence Permit from the process & tax perspective.

What about Global Residence Programme?

The Nomad Residence Permit (NRP) is just one of the programs that exist in Malta. A notable alternative to the NRP for anyone interested in becoming a full-on tax resident in Malta is the Global Residence Programme (GRP). In the Global Residence Programme, grantees (including their spouse and children) have to remit at least €100,000 in earnings to Malta every year and pay a minimum of €15,000 tax annually – 15 percent of their remittances.

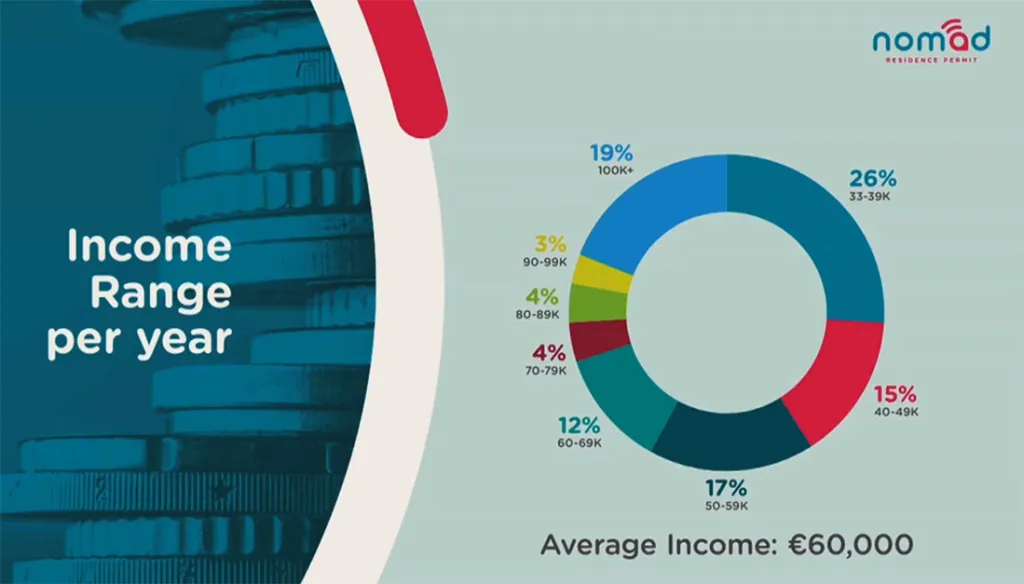

According to recent stats from Malta’s Residency Agency, one in five holders of the NRP are earning over €100,000 from their employment or self-employment jobs based outside of Malta. In his recent post, Victor Borg, an investigative journalist, who quite often writes about Malta and its residency programs, raises an interesting question: Does the NRP open the door to tax avoidance for high earners?

It’s definitely a thought-provoking article but the Global Residence Programme actually provides a person with tax residence (for non-EU, non- EEA, and non- Swiss nationals) while the Nomad Residence Permit does not. Under the NRP you become a temporary resident who is not domiciled and doesn’t become a tax resident of Malta. Plus you can’t remit and use any money in Malta if you don’t want to pay tax there. If you do want to be a tax resident and are on GRP, you are a tax resident and can remit and use your money in Malta. Some people, who don’t like the taxes back home might actually want to become the tax residents somewhere and apply for GRP. Not having tax residency would usually become problematic sooner or later.

How does it compare?

What is great is that the Nomad Residence team is very vocal and clear on the fact that there is no income tax for up to a year. For anyone who has a tax residency back home, this is great.

This is almost Caribbean style, where countries that provide similar ‘no income tax’ exemptions are very clear on local vs home tax residencies. In comparison, this is very different in places like Estonia and Croatia where you might end up being liable for local taxes after 183 days there. And this is regardless of your tax residency back home.

In Malta, there are no issues and risks of local taxes & residency as long as you don’t provide services in Malta. This could be very nice & simple. What makes it quite strange and worrying is that their Tax Office is a bit confused about what the tax treatment of Nomadas should be.

For more, please see the MALTA Nomad Residence Permit

Footnotes

At Global Nomad Guide, we take our role seriously and put a lot of effort into assuring that all the information about Remote Work Visas is reliable and accurate. Read about how we verify the digital nomad Visas info.

Disclaimers

Please note that even though we do our very best to verify all the content, Global Nomad Guide is here to give you an overview of what’s available. The information we provide should not be considered legal opinion, tax, or financial advice. You should always seek expert advice. If you want to receive a legal opinion or tax advice, please contact us, and we will refer you to a legal practitioner.

Feedback

Also, we are only humans, so if you see that anything is missing or if there is a new visa that we haven’t covered yet? Let us know, and we will add it in ASAP!

If you belong to a tourist organization or other governmental body responsible for your country’s Remote Work Program and would like to have it featured on the Global Nomad Guide, please reach out to us via chat or contact form.

1ACT Advisory Services Ltd. 2PWC Worldwide Tax Summaries

Last updated October 13, 2022.

REVIEW

FAVOURITES

SHARE

NEWSLETTER

No Spam, Just Updates!

FOLLOW US

DIGITAL NOMAD VISAS

I am an Indian citizen and want to understand more about Nomad visa. Your article almost clears everything. However, I want to understand that am I eligible to get the Nomad visa from India and do I need to travel to Malta occasionally? Please advice.

Hi, glad the article answered most of your questions. We can’t unfortunately advise on particular cases, but hope you can find answers to your questions on the MALTA Nomad Residence Permit page. Alternatively please try to post them in the Facebook Q&A group.