Over the last week, Global Nomad Guide has been investigating issues with Tax Exemption under Malta’s Nomad Residence Permit. Despite previous assurances from Malta Residence Agency that Nomads will not own any income tax in Malta, people who already hold the permit were told by Malta’s Commission For Revenue (CFR) that they will have to pay tax if they stay longer than 183 days. Turns out the tax exemption hasn’t been properly written and implemented into Malta’s Income Tax laws. A huge oversight on Malta’s part.

That said, the moment we raised the alarm bells, Malta’s response was almost instant. Within 48 hours, we received information from Mr. Byron Camileri, Minister of Home Affairs, confirming that Malta Residence Agency and Commission For Revenue are now both working together to resolve this issue. Read on for details of what the whole mess is about and original information from Minister Camileri, who assured Global Nomad Guide that this issue would not have an impact on anyone who is already a holder of the Nomad Residence Permit.

Read the latest info in Malta Announces New Income Tax Rules For Digital Nomads.

Jun 2021 – Malta promotes their Nomad Residence Permit, under which, Digital Nomads will pay 0% income tax in Malta.

Feb 2022 – Global Nomad Guide finds out there is a lack of legal bases for this tax exemption. We advise all digital nomads to proceed with caution.

3rd Oct 2022 – Reports from the Permit holders who are being told by the Commission For Revenue (CFR) that they will have to pay tax on income from their remote jobs (even if not remitted to Malta) if they spent more than 183 days in Malta.

4th Oct 2022 – Global Nomad Guide rings bells on the mistreatment of Nomad Residency Permit holders who were promised: “no tax”, yet now are being told to pay. We also reached out to Residency Malta Agency & Silvio Schembri, the Minister of Economy, for comments.

6th Oct 2022 – Global Nomad Guide receives a confirmation from Byron Camileri, Malta’s Ministry of Home Affairs, that Malta is working on resolving the issue and that existing Nomad Residence Permit holders, will not be negatively impacted.

To Be Continued We will keep monitoring the situation & provide you with updates. If you don’t want to miss them, please consider signing up for our newsletter. And if you have been affected, please feel free to reach out to us.

If you have time, here is a slightly longer summary of what are the problems and what was Malta’s response.

Malta advertises 0% Income Tax with Nomad Residence Permit

Residency Malta Agency, responsible for promoting the Digital Nomad permit, confirmed on multiple occasions that Nomads would not pay any tax on income from their remote jobs if it is not remitted to Malta. This tax exemption was a big selling point for Malta’s version of a Digital Nomad Visa. It was also one of the reasons why the Malta Nomad Residence Permit scored 7 out of 10 points on the Global Nomad Index© and why we were recommended it as one of the best programs in Europe.

Lack of legal bases for the Nomad Tax Exemption

As part of the due diligence that Global Nomad Guide does, when we gather info about any digital nomad visa; in February 2022, we investigated What Taxes will Digital Nomads Really Need To Pay In Malta? under the Nomad Residence Permit. We talked to the Residency Malta Agency (RMA) and Commission For Revenue (CFR) and found out that what CFR is saying about taxes for nomads vs what RMA is saying are very different things.

While RMA was claiming that nomads will not pay tax: “Income arising outside of Malta and not sent to Malta is not taxable when holding a Nomad Residence Permit,” the CFR confirmed there are no provisions in Malta’s Income Tax laws that would allow for this. They said: “The Income Tax Act currently does not cater for the exemption of tax on income earned from remote working by Nomad Resident Permit holders. Therefore at the moment, we are not aware of how the tax exemption for Nomad Residence Permit holders is going to apply.”

Global Nomad Guide has cautioned about this all the Nomads who want to apply for Nomad Residence Permit. We also hoped this was just a misunderstanding between the government agencies, but we have closely monitored the situation.

Nomads report issues with Tax Exemption

Early in October this year, there were separate reports on Reddit, in Malta’s Digital Nomads Facebook & Telegram Groups. We talked to several Digital Nomads, who were saying they have been told by CFR they will need to pay taxes on their remote income if they stay in Malta for more than 183 days. You can find out more about this, in the post No Tax Exemption under Malta Nomad Residence Permit?

This has confirmed our initial suspicions that it isn’t just a small miscommunication error between CFR & RMA. This means that Malta has announced and run its program, for over a year, without sorting out the details of the tax policy they offer under the program. We were worried this might happen but hoped it won’t. Now that it did, it needed to be addressed.

Holding Governments Accountable

One of the reasons we have created the Global Nomad Guide is to ensure that all Digital Nomads and other Remote Workers have easy access to information about the tax implications of Digital Nomad Visas. The other one was to have a platform that, if needed, could advocate on behalf of nomads. It’s difficult to hold governments accountable if you are just one person, but together we can.

On the 4th of October, Global Nomad Guide published an article on what is happening: No Tax Exemption under Malta Nomad Residence Permit? We have also contacted the Residency Malta Agency and Mr. Silvio Schembri, Malta’s Minister of Economy, for comments.

Malta’s Quick Response

The same day on the 4th we received information from Vicky Spiteri from Residency Malta Agency, who, without fully acknowledging the issue, said they are “working closely with the Office of the Commissioner for Revenue” to solve find a solution; she also confirmed that this will be solved “without impacting existing beneficiaries.”

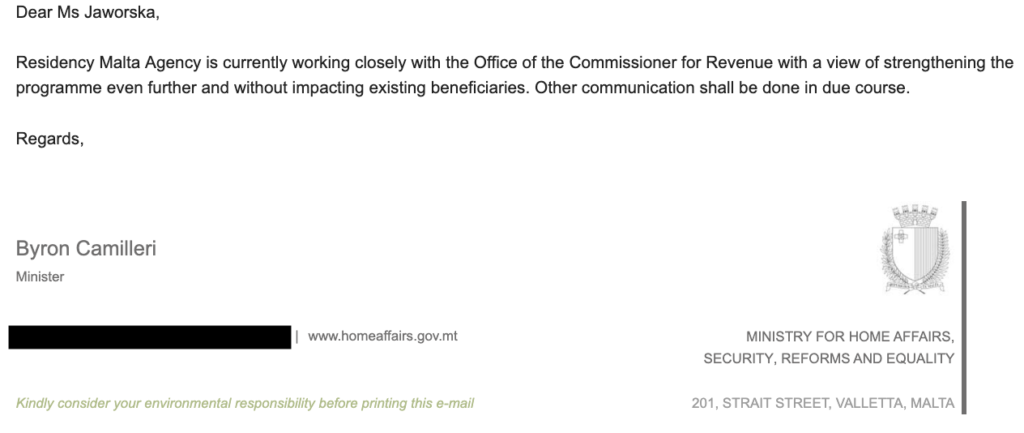

Minister Silvio Schembri has kindly put us in touch with Minister Byron Camileri, responsible for Home Affairs, Security, Reforms & Equality. Within 48hours of publishing the article, we received the official statement from Minister Camileri saying confirming what was already said by Ms. Vicky from RMA. Here is the exact info we have received:

Malta’s response has been very prompt, and we highly appreciate that they have taken on the feedback and are working on fixing the issues. We are very happy to hear that both RMA and Mr. Camilleri confirmed that this situation would not negatively affect the existing permit holders. This is something that is crucial and that we will make sure to follow up on.

What to do if you are affected?

When asked when the issue will be resolved, we were told: “it will be soon.” We will need to wait to see how long it will take Malta to find the solution and, this time, vote it into law properly. It might be a while, but we will keep you posted.

In the meantime, if you are affected here is what you can do:

- CFR is now aware that they can’t force Nomads to pay the taxes; they are working with RMA to sort this out.

- However, if you have any issues with CFR, please present them with a copy of the above email from Minister Camilleri. This should be sufficient to stop their demands. You can also send them the link to this article.

- Please let us know if you have any further issues and let us know so we can take this again to Mr. Camilleri.

- It is always worth reaching out to a local tax advisor who can help you navigate the issue and mitigate the situation until further solutions are in place.

Hopefully, this should be sufficient to help you. Global Nomad Guide will stay on the case, and we will share more details with you as soon as possible.

Last updated December 15, 2023.

REVIEW

FAVOURITES

SHARE

NEWSLETTER

No Spam, Just Updates!

FOLLOW US

DIGITAL NOMAD VISAS

Is there any update regarding this issue?

Unfortunately we have not received any updates. We will keep chasing them for the answer.